By helping customers build wealth through micro-investing, our client has become the largest subscription service in U.S. consumer finance, with nearly 5 million users.

Wealth management fintechs play an important role in empowering consumers to save and invest, regardless of their net worth. The linchpin to the process is the direct deposit because before users can save and invest, they need to fund their accounts.

Our client, a top 5 wealth management fintech, approached us to integrate a solution to streamline direct deposit switching for millions of their users so they could take full advantage of the products and services offered.

Manual process prevented capturing more direct deposits

Prior to working with Pinwheel, direct deposit setup was a time-consuming process.

Our client’s app only provided users with account and routing numbers and a pre-filled direct deposit form. It was then left up to the individual user to take the information from the app and give it to their employer.

The process was manual from start to finish, which meant the company had no way to track or analyze the KPIs for direct deposits, and didn’t have a clear picture of the user journey — including which users were planning to even attempt a switch. Worse, the company couldn’t reach out to them if they needed help overcoming the unnecessary friction in the user setup process.

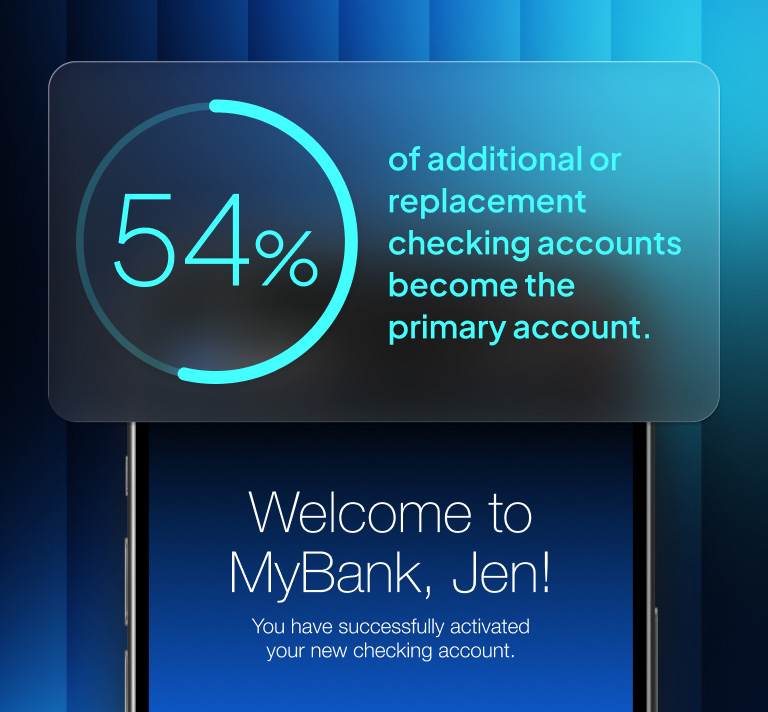

Without an easy way for customers to set up direct deposit, the company knew they were missing the opportunity to become the primary financial account for more of its customers. Considering automated direct deposit setup is the most in-demand mobile account opening feature, with 39% of consumers calling it “extremely valuable,” they rightly prioritized implementing automated direct deposit switching with the help of Pinwheel.

Implementing automated direct deposit switching with Pinwheel

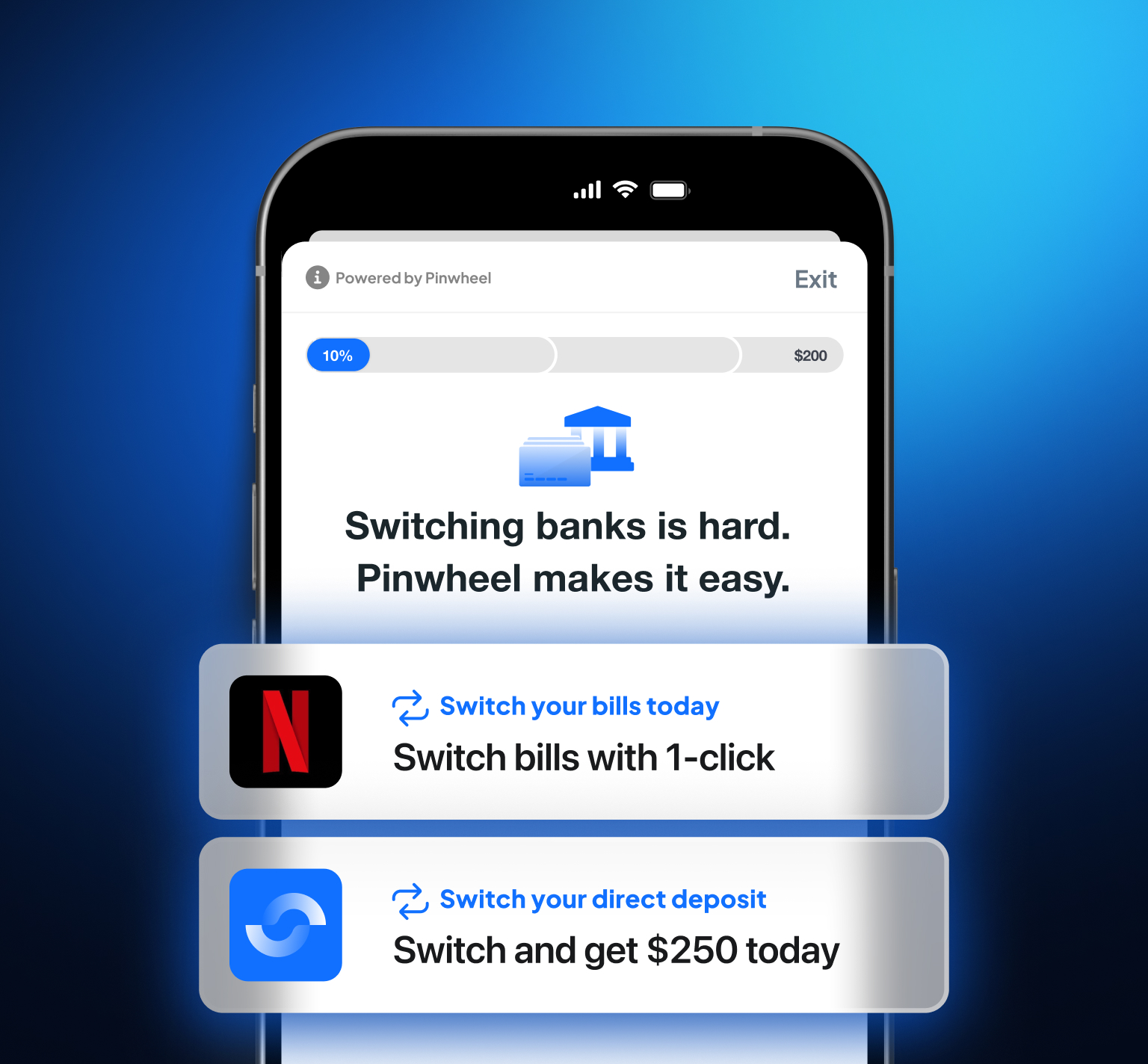

Pinwheel is an industry-leading payroll data connectivity API that can effortlessly automate direct deposit switching.One of the reasons why our client chose Pinwheel is our coverage, which is the highest in the industry at 1,600 payroll and income platforms, covering 80% of U.S. employees.

“Customer experience is a top priority of ours. By partnering with Pinwheel, we know we're offering our customers the strongest coverage and highest quality experience.” - client leadership

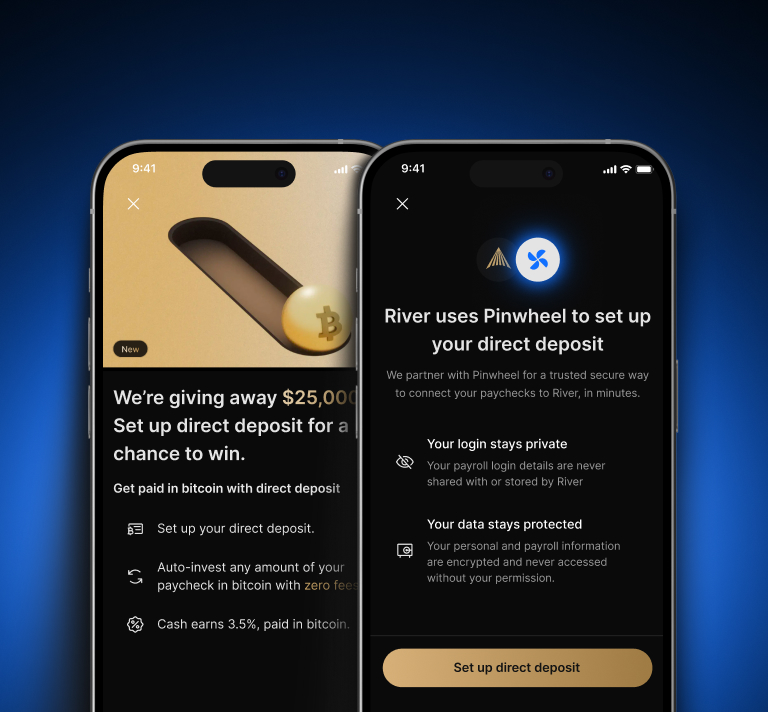

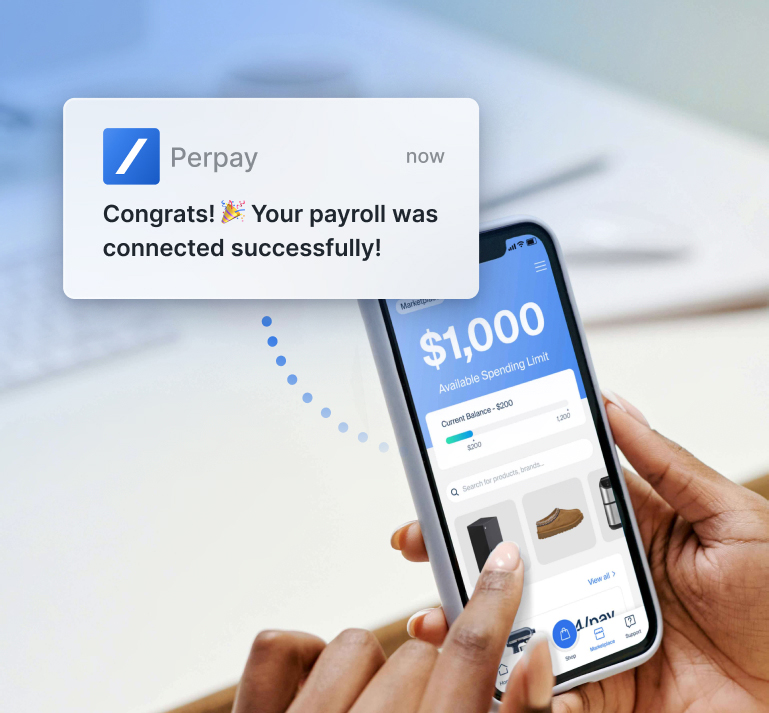

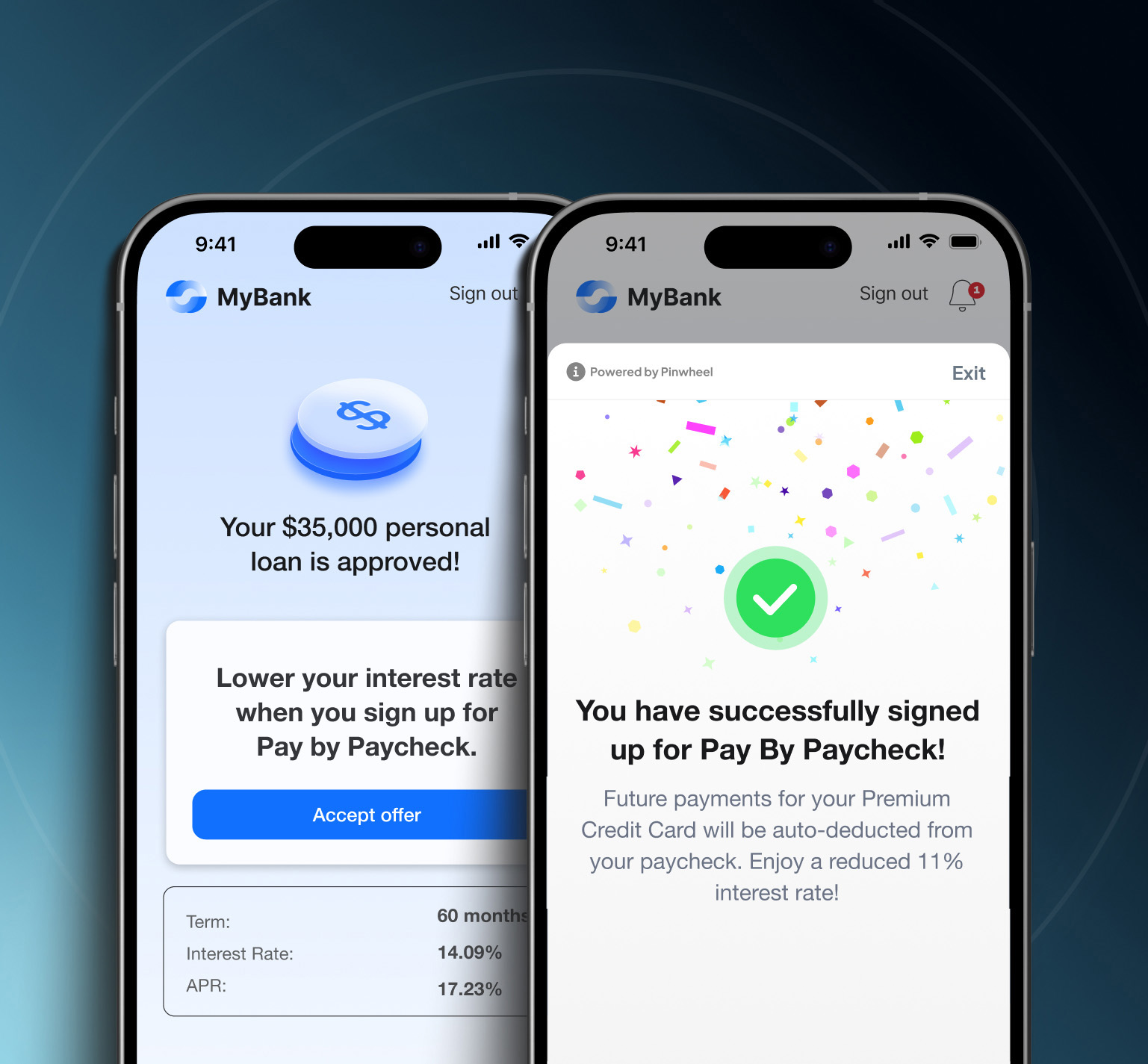

Here’s what the direct deposit setup experience looks like after integrating Pinwheel’s API:

"The Pinwheel team’s deep expertise of our needs, goals, and the fintech space is an invaluable asset in our partnership. Their collaborative approach is second-to-none!" - client leadership

By automating the deposit switch process and providing users with a simple way of managing their paycheck settings, our client is set up for success in growing customer engagement and enabling them to save and invest automatically from every paycheck.

Unparalleled user insights and support from Pinwheel

When our client automated the direct deposit switching process with Pinwheel, the company saw an immediate improvement in the user experience. But it also gained valuable insights into its users.

"With Pinwheel, we gain access to granular customer experience data, allowing our team to continually optimize our experience, improve conversion, and grow our business." - client leadership

After the launch of the new automated deposit switching feature, they also saw an increase in the overall volume of direct deposit customers. Once the company carries out more tests, it expects even more conversions and growth at the top of the funnel.

Additionally, in order to successfully drive user adoption, they leveraged Pinwheel’s direct deposit switching best practices toolkit to effectively market this offering to its users.

Automating direct deposit switching also helps users too. With Pinwheel, users can set up their new direct deposit settings within minutes, all directly from the app, making the user experience seamless and delightful.

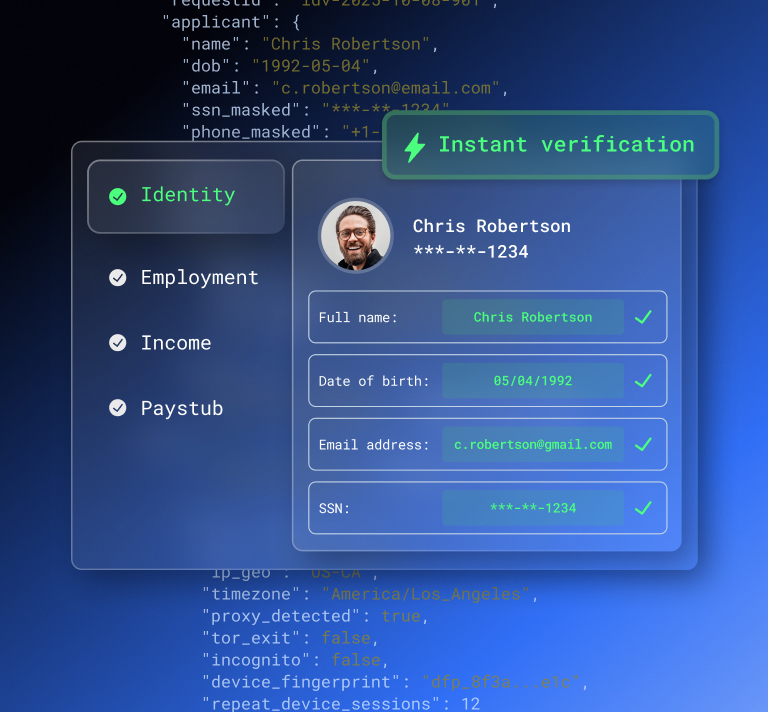

The next step was to enrich its user data with Pinwheel Verify. This solution provides verified income and employment data from payroll and income platforms and allows financial service providers to improve loan underwriting, and more. With this data, customers can expand loan access to their users. Since the income data provided is more comprehensive than a credit score, better underwriting decisions can be made to lower credit borrowers.

Now, the company can learn more about its users’ financial needs from their income and employment data and continue to be the leading provider of saving and investing services for millions of consumers.

.svg)

.svg)